Reaching for High Yields?

Who doesn’t want to earn a high yield? Isn’t that the objective of investing? The name “High Yield” fund just sounds right, and so much better than the previous name of “Junk Bond” fund. High Yield funds or Junk Bond funds invest in debt securities of non-investment grade corporations, many of which are considered risky, speculative, or vulnerable by the ratings agencies. With interest rates artificially suppressed, and investors so willing to risk more for higher yields, the incremental return high yield investors now earn has rarely been so low.

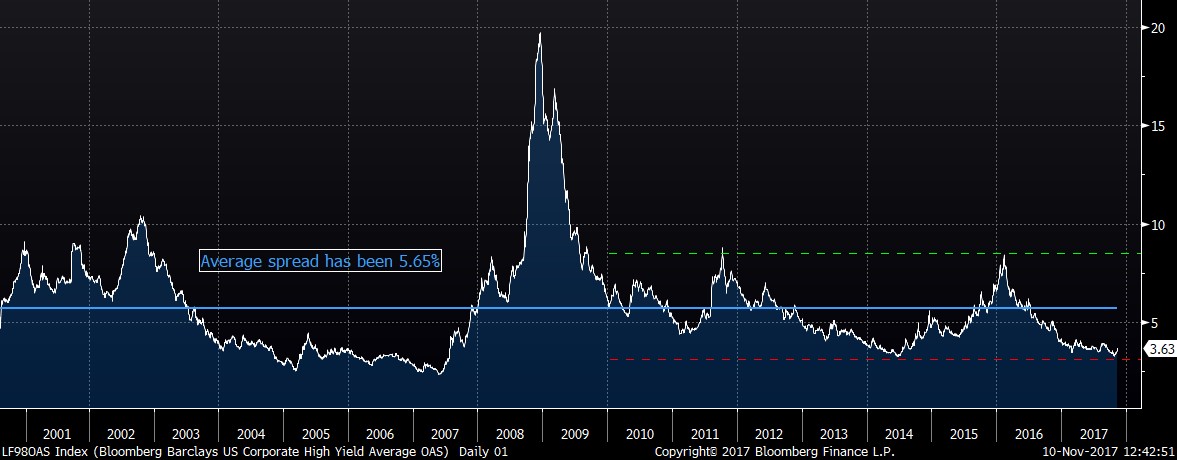

In the chart below, we graphed the high yield bond index spread over risk free treasury bonds since January of 2000. During the global financial crisis of 2008 – 2009, investors could have purchased high yield bonds with yield spreads in excess of 15% and briefly near 20%. If you did, then I congratulate you and say, “well done”. At those rates, it was as if, how could you lose. Today however, the extra yield of 3.6% is well below the 5.65% long term average, is approaching the lowest rates of the past three years, and is only modestly more than those observed during the 2006 to 2007 real estate bubble. If you still own high yield today, and the market experiences normal default rates, or interest rates rise materially, how can you expect to win?

Bloomberg Barclays US Corporate High Yield Spread since 2000

The problem with corporate debt

Corporate debt and especially high yield corporate debt securities have several unattractive traits for fixed income investors. Credit risk is the risk of default and risk of failure to receive payments of interest and/or principal. Credit risk for high yield corporate debt is significantly higher than investment grade or government securities. In addition, illiquidity abounds in the high yield market, and many securities trade by appointment only. Furthermore, a high correlation to equities makes high yield debt a poor choice for portfolio diversification in times of economic recession or equity market declines, as both typically decline in unison. Finally, high yield securities have call features which pose a “heads you win, tails I lose” proposition for the holders of high yield corporate debt.

What is an investor to do?

Interest rates are abnormally low, and the Federal Reserve appears committed to raising interest rates modestly while beginning the effort to remove the excess liquidity provided by the asset purchase program. While we do not advocate trying to time the market or predict interest rates, most investors are justified in having an allocation to fixed income. Despite the fact that interest rates are low today, there are benefits to maintaining a portfolio which is well diversified among asset classes including fixed income. But, unless you are being offered higher than average yields to compensate for the negative features of high yield corporate debt, which is not the case today, then shorter duration government securities and high quality investment grade corporate bonds, seem like a better choice than high yield within fixed income portfolios.

For your convenience, we have listed a few of the most widely held high yield funds that investors may have exposure to. Review your portfolio and check with your adviser to make sure any allocation to high yield and junk bonds is still appropriate for you.

iShares IBOXX High Yield ETF

SPDR BBG Barclays High Yield ETF

Vanguard High Yield Corp Fund

Blackrock High Yield Portfolio

American Funds High-Income Trust

Fidelity Capital & Income Fund

PIMCO High Yield Fund

JP Morgan High Yield Fund